EFAMA: Cyprus consolidates its position as an international hub for Investment Funds

- The sector’s growth rate in Cyprus in the last few years has been far greater than its European counterparts

- Useful conclusions from the Digital Workshop: “The post-pandemic landscape for Cyprus Investment Funds”

CIFA, in cooperation with Invest Cyprus, organised the first Digital Workshop, “The post-pandemic landscape for Cyprus Investment Funds,” which attracted a large number of participants.

Experts in the field of Investment Funds presented the latest global and local developments and analysed the sector’s trajectory in the post-pandemic era. Andreas Yiasemides, CIFA’s President, analysed the sector’s rise, which had an upward trajectory in the last five years, during which Investment Funds saw their assets under management grow to the point that they are currently exceeding €8.5 billion. The number of Investment Funds and Managers also showed a corresponding increase.

Invest Cyprus CEO and CIFA Vice-President George Campanellas, explained that the Investment Funds sector is one of the main strategic pillars for attracting investments in Cyprus and that the interest, insofar, has been strong.

Particularly important was the contribution of George Theocharides, the Vice-Chairman of the Supervisory Authority, who analysed the actions taken by the Cyprus Securities and Exchange Commission in relation to the sector’s oversight and the upcoming legal and regulatory changes.

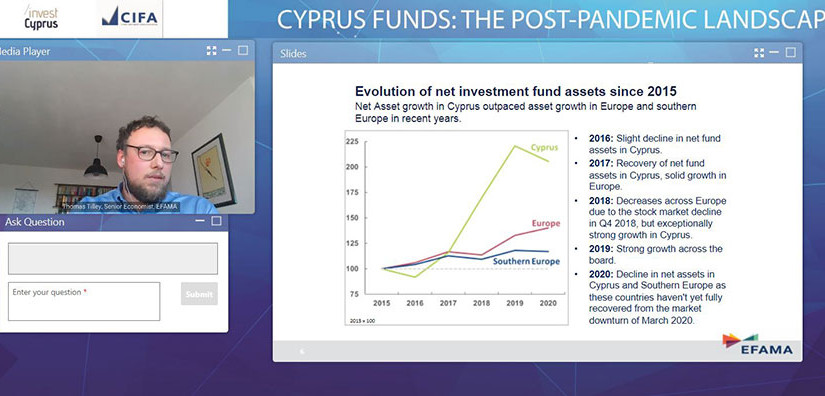

Thomas Tilley, Senior Economist at EFAMA (European Funds and Asset Management Association), presented the international trends for Collective Investments. Tilley presented some particularly positive developments in relation to Cyprus, like the fact that the growth rate of the sector in the last few years has been far greater than its counterparts in Central and Eastern Europe. At the same time, Tilley pointed out that Cyprus is evolving into a cross-border hub for Investment Funds. Specifically, at the end of 2020, 47% of the net assets in Cyprus were held by cross-border funds. This particular trend shows that Cyprus is growing into a new European destination for international Investment Funds, since only Ireland (92%), Luxembourg (76%) and Malta (76%) concentrate higher percentages – these are destinations that have been servicing Investment Funds for decades.

CIFA’s board member George Karatzias presented the characteristics of both Investment Funds and Investment Funds Managers that operate in Cyprus and the requirements for getting licenced. Margarita Liasi, CIFA member, analysed the tax provisions in relation to Cyprus Investment funds, investors and Managers. Finally, CIFA’s Vice-President Panikos Teklos explained how Cyprus is emerging as a European centre for asset management and a Fund Hosting Jurisdiction.

The event was chaired by Marios Tannousis, Deputy Director General of Invest Cyprus and Cyprus Representative at EFAMA, of which CIFA is a member.

CIFA, in collaboration with Invest Cyprus, is planning a series of free digital workshops in the coming months, aiming to educate and inform its members and the general public about the latest developments surrounding the sector of Investment Funds, among other things.